The Role of a Payment Gateway in Streamlining Ecommerce Settlements and Enhancing Customer Experience

The integration of a payment gateway is pivotal in the e-commerce landscape, serving as a safe avenue in between vendors and consumers. By enabling real-time deal handling and sustaining a range of repayment techniques, these entrances not just mitigate cart desertion yet additionally boost general customer satisfaction. Their emphasis on protection and openness cultivates trust in a significantly competitive industry. As we check out the complex advantages of payment portals, it comes to be necessary to check out exactly how these systems can even more evolve to fulfill the needs of both services and consumers alike.

Understanding Repayment Portals

A repayment portal offers as a critical intermediary in the ecommerce purchase process, promoting the protected transfer of settlement details between merchants and clients. 2D Payment Gateway. It makes it possible for online companies to approve numerous forms of repayment, consisting of credit rating cards, debit cards, and electronic purses, thus broadening their client base. The portal operates by encrypting delicate details, such as card details, to guarantee that data is sent safely online, reducing the threat of scams and information violations

When a customer initiates a purchase, the repayment entrance catches and forwards the purchase information to the ideal financial organizations for consent. This procedure is generally seamless and happens within seconds, supplying clients with a liquid purchasing experience. In addition, settlement portals play a crucial duty in conformity with industry standards, such as PCI DSS (Settlement Card Market Information Protection Criterion), which mandates strict protection steps for processing card repayments.

Understanding the technicians of repayment gateways is important for both customers and vendors, as it directly influences deal efficiency and consumer trust. By ensuring safe and secure and effective deals, payment entrances add dramatically to the general success of e-commerce organizations in today's digital landscape.

Key Functions of Repayment Entrances

Numerous essential attributes define the performance of repayment gateways in shopping, guaranteeing both protection and benefit for customers. One of one of the most critical attributes is robust safety protocols, including security and tokenization, which safeguard sensitive customer data throughout transactions. This is necessary in fostering count on in between sellers and consumers.

Furthermore, real-time transaction handling is crucial for making sure that payments are finished swiftly, decreasing cart abandonment prices. Payment portals likewise provide fraudulence detection devices, which keep an eye on transactions for dubious activity, more securing both consumers and sellers.

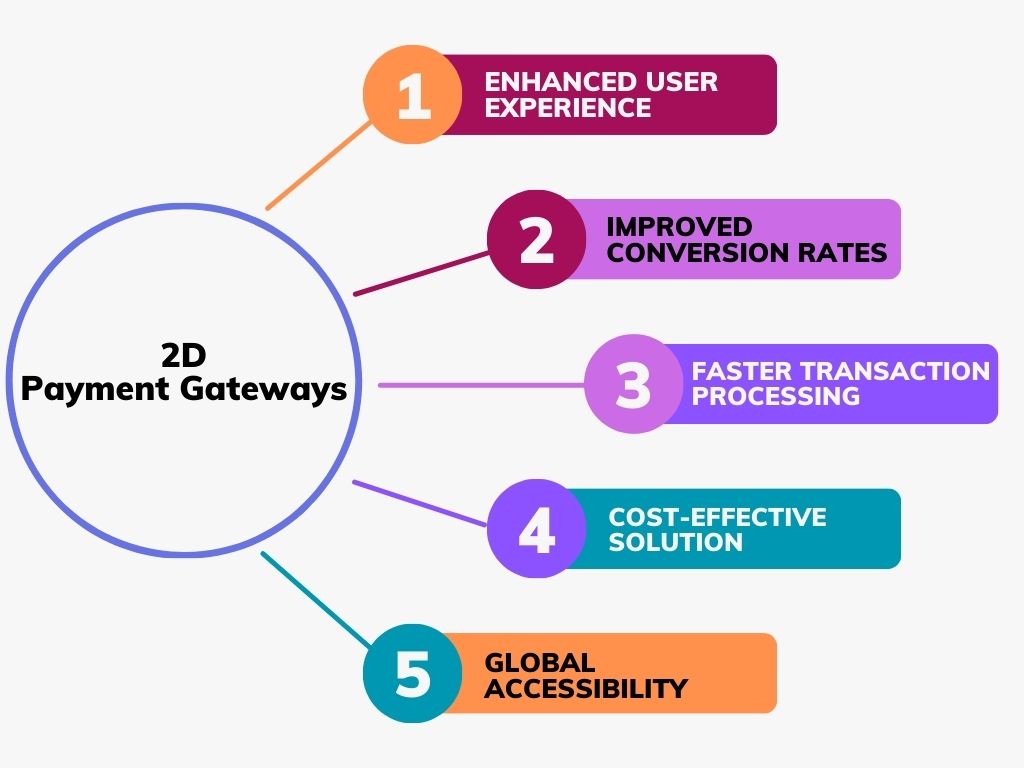

Benefits for Shopping Services

Numerous advantages emerge from incorporating payment entrances into ecommerce businesses, significantly enhancing functional efficiency and client complete satisfaction. Payment entrances facilitate seamless purchases by securely processing settlements in real-time. This capability decreases the chance of cart abandonment, as customers can quickly finish their purchases without unnecessary delays.

In addition, payment gateways support several repayment approaches, fitting a varied variety of client preferences. This flexibility not only draws in a more comprehensive client base however likewise fosters commitment among existing clients, as they really feel valued when offered their preferred payment options.

Furthermore, the combination of a settlement entrance commonly causes boosted safety functions, such as encryption click for more info and fraud discovery. These steps protect delicate client info, therefore constructing count on and credibility for the ecommerce brand name.

In addition, automating repayment procedures via portals reduces manual work for staff, enabling them to focus on address tactical campaigns instead of routine jobs. This operational efficiency converts right into cost financial savings and improved source allowance.

Enhancing Individual Experience

Incorporating a reliable repayment entrance is critical for enhancing individual experience in shopping. A smooth and reliable settlement process not only constructs customer trust however likewise minimizes cart desertion prices. By supplying several payment options, such as charge card, digital wallets, and financial institution transfers, services accommodate diverse client choices, therefore improving complete satisfaction.

In addition, a straightforward interface is important. Repayment gateways that use user-friendly navigating and clear directions enable clients to complete deals swiftly and effortlessly. This simplicity of usage is essential, particularly for mobile shoppers, that call for enhanced experiences tailored to smaller sized displays.

Protection features play a significant function in user experience. Advanced file encryption and scams detection systems guarantee consumers that their sensitive data is secured, promoting self-confidence in the purchase procedure. Furthermore, clear communication concerning policies and charges enhances integrity and lowers prospective aggravations.

Future Fads in Settlement Processing

As shopping remains to develop, so do the trends and technologies shaping repayment processing (2D Payment Gateway). The future of repayment processing is marked by numerous transformative patterns that assure to boost performance and individual contentment. One significant fad is the increase of expert system (AI) and device discovering, which are being increasingly integrated right into settlement portals to bolster security through innovative fraudulence detection and threat assessment

Additionally, the adoption of cryptocurrencies is obtaining grip, with even more businesses checking out blockchain technology as a practical choice to traditional payment approaches. This shift not just offers lower purchase fees however additionally interest an expanding demographic that values decentralization and personal privacy.

Mobile wallets and contactless settlements are coming to be mainstream, driven by the need for quicker, extra convenient deal approaches. This pattern is more fueled by the enhancing frequency of NFC-enabled tools, enabling More hints seamless deals with just a faucet.

Finally, the emphasis on regulative conformity and information defense will certainly form payment processing techniques, as services make every effort to build trust with consumers while sticking to developing legal frameworks. These patterns collectively suggest a future where repayment processing is not just faster and much more safe however likewise a lot more straightened with customer assumptions.

Final Thought

Finally, repayment gateways act as vital components in the e-commerce environment, helping with safe and secure and efficient transaction handling. By offering diverse repayment alternatives and prioritizing individual experience, these entrances dramatically decrease cart desertion and boost customer contentment. The ongoing evolution of repayment technologies and protection measures will even more enhance their duty, making certain that e-commerce companies can meet the demands of significantly sophisticated customers while promoting depend on and trustworthiness in online deals.

By enabling real-time purchase handling and supporting a selection of settlement methods, these entrances not only reduce cart desertion but also boost general consumer fulfillment.A payment gateway serves as a crucial intermediary in the e-commerce purchase process, facilitating the safe transfer of settlement info between clients and merchants. Payment portals play a crucial duty in conformity with industry criteria, such as PCI DSS (Settlement Card Market Data Safety And Security Standard), which mandates rigorous safety steps for processing card repayments.

A versatile settlement entrance accommodates credit rating and debit cards, electronic budgets, and alternative repayment methods, providing to varied customer choices - 2D Payment Gateway. Repayment portals assist in seamless transactions by firmly processing settlements in real-time